How to Purchase Reverse Mortgage and Maximize Your Home’s Value

How to Purchase Reverse Mortgage and Maximize Your Home’s Value

Blog Article

Empower Your Retirement: The Smart Method to Acquisition a Reverse Home Loan

As retired life approaches, lots of individuals seek reliable approaches to improve their monetary freedom and well-being. Amongst these strategies, a reverse home mortgage emerges as a sensible option for house owners aged 62 and older, enabling them to tap into their home equity without the need of regular monthly repayments.

Comprehending Reverse Mortgages

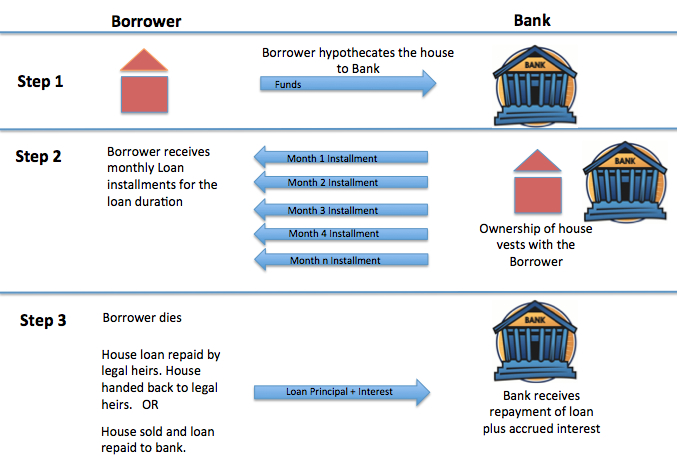

Understanding reverse home loans can be important for property owners looking for monetary flexibility in retirement. A reverse home mortgage is a monetary product that permits eligible house owners, commonly aged 62 and older, to convert a part of their home equity into money. Unlike standard mortgages, where customers make month-to-month repayments to a loan provider, reverse home loans make it possible for homeowners to get repayments or a swelling sum while retaining possession of their home.

The quantity available through a reverse mortgage depends upon a number of aspects, including the home owner's age, the home's value, and present interest rates. Importantly, the funding does not have to be paid off up until the home owner offers the home, vacates, or passes away.

It is essential for possible customers to understand the implications of this monetary product, consisting of the influence on estate inheritance, tax factors to consider, and continuous responsibilities associated with residential or commercial property maintenance, tax obligations, and insurance. In addition, counseling sessions with licensed specialists are frequently called for to guarantee that customers totally comprehend the terms of the car loan. Generally, a detailed understanding of reverse mortgages can encourage homeowners to make educated decisions concerning their economic future in retirement.

Advantages of a Reverse Mortgage

A reverse home mortgage uses several engaging benefits for qualified property owners, especially those in retired life. This financial device permits senior citizens to transform a portion of their home equity right into cash, supplying vital funds without the need for monthly mortgage settlements. The cash obtained can be utilized for various functions, such as covering clinical expenses, making home enhancements, or supplementing retirement earnings, therefore improving overall economic adaptability.

One significant advantage of a reverse home mortgage is that it does not need repayment up until the property owner vacates, sells the home, or dies - purchase reverse mortgage. This attribute enables senior citizens to keep their way of life and fulfill unforeseen costs without the problem of month-to-month settlements. In addition, the funds obtained are typically tax-free, permitting property owners to utilize their cash without worry of tax ramifications

Additionally, a reverse home loan can provide satisfaction, knowing that it can work as a monetary safety internet during difficult times. Homeowners likewise preserve possession of their homes, guaranteeing they can proceed residing in an acquainted setting. Inevitably, a reverse home mortgage can be a calculated funds, encouraging retired people to handle their financial resources properly while enjoying their gold years.

The Application Refine

Navigating the application process for a reverse home mortgage is an important action for homeowners considering this financial option. The initial phase involves assessing eligibility, which normally calls for the homeowner to be at the very least 62 years of ages, own the property outright or have a low home loan equilibrium, and occupy the home as their key home.

Once eligibility is verified, homeowners need to go through a counseling session with a HUD-approved counselor. This session guarantees that they completely recognize the ramifications of a reverse home mortgage, including the responsibilities included. purchase reverse mortgage. After completing therapy, applicants can proceed to gather click this link necessary documents, consisting of proof of earnings, assets, and the home's value

The next step requires sending an application to a lender, that will certainly analyze the economic and building credentials. An evaluation of the home will also be conducted to establish its market price. If approved, the lender will certainly provide funding terms, which need to be evaluated carefully.

Upon acceptance, the closing process adheres to, where final files are authorized, and funds are disbursed. Understanding each stage of this application process can substantially improve the home owner's self-confidence and decision-making pertaining to reverse home loans.

Key Factors To Consider Prior To Investing In

Getting a reverse home loan is a considerable monetary decision that calls for careful factor to consider of a number of key aspects. First, comprehending your eligibility is essential. Homeowners should be at least 62 years of ages, and the home must be their main residence. Evaluating your economic demands and objectives is equally crucial; figure out whether a reverse home loan aligns with your lasting plans.

In addition, examine the impact on your present way of living. A reverse home loan can affect your qualification for certain federal government advantages, such as Medicaid. Look for specialist assistance. Consulting with an economic consultant or a housing counselor can supply beneficial understandings tailored to your specific circumstances. By completely reviewing these considerations, you can make a much more informed decision about whether a reverse home mortgage is the appropriate financial approach for your retired life.

Maximizing Your Funds

When you have safeguarded a reverse home mortgage, efficiently handling the funds ends up being a top priority. The adaptability of a reverse mortgage permits property owners to use the funds in different means, however strategic planning is vital to optimize their benefits.

One key technique is to develop a budget plan that details your monthly costs and monetary goals. By determining required costs such as health care, real estate tax, and home maintenance, you can assign funds appropriately to make sure long-lasting sustainability. Additionally, consider utilizing a part of the funds for investments that can generate income or appreciate see page gradually, such as dividend-paying supplies or shared funds.

One more vital aspect is to keep an emergency fund. Reserving a reserve from your reverse mortgage can assist cover unexpected prices, offering satisfaction and financial security. Seek advice from with a financial consultant to check out feasible tax ramifications and exactly how to incorporate reverse mortgage funds into your general retired life method.

Inevitably, sensible administration of reverse home loan funds can enhance your economic security, allowing you to enjoy your retirement years without the tension of economic uncertainty. Cautious preparation and informed decision-making will make certain that your funds function efficiently for you.

Verdict

In verdict, a reverse mortgage offers a sensible monetary method for seniors seeking to boost their retirement experience. By converting home equity into obtainable funds, individuals can attend to important costs and safe added financial sources without sustaining regular monthly settlements.

Comprehending reverse home loans can be crucial for home owners looking for financial adaptability in retirement. A reverse mortgage is a monetary item that enables qualified property owners, typically aged 62 and older, to transform a portion of their home equity right into cash. Unlike typical home mortgages, where consumers make monthly settlements to a lending institution, reverse mortgages allow home owners to get settlements or a swelling sum while maintaining ownership of their residential or commercial property.

Overall, a thorough understanding of reverse home loans can equip property owners to make enlightened choices about their monetary future in retired life.

Seek advice from with a monetary advisor to discover feasible tax implications and just how to incorporate reverse home loan funds right into your total retired life approach.

Report this page